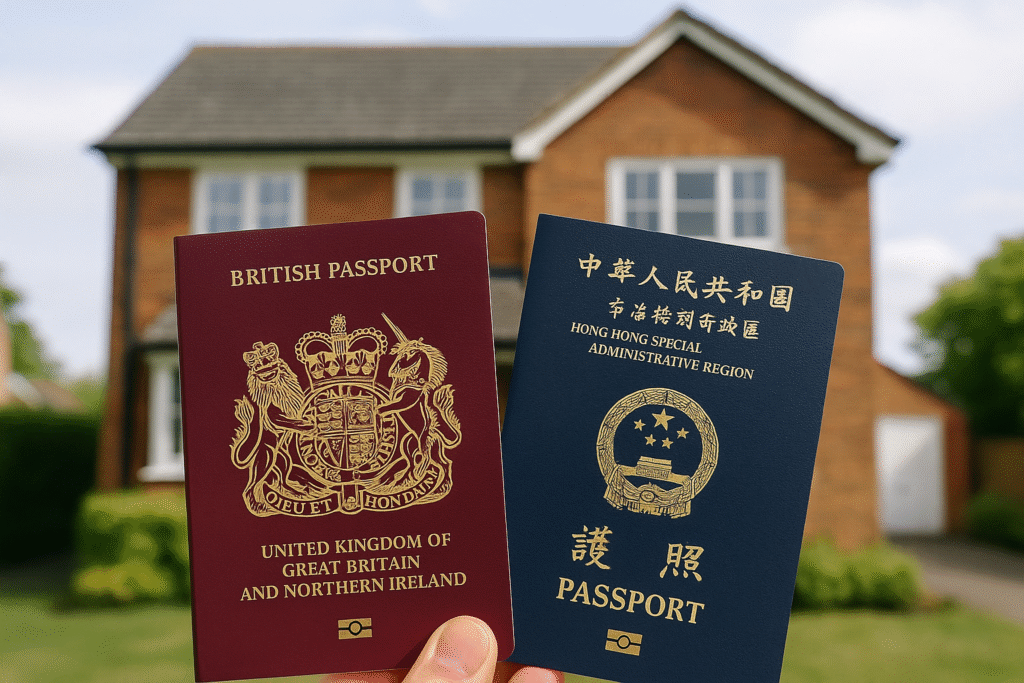

When moving from Hong Kong to the UK under the British National (Overseas) — or BNO — visa scheme, one of the biggest steps people dream about is buying their own home.

But many new arrivals ask the same question:

“Is it difficult for Hong Kong BNO visa holders to get a mortgage in the UK?”

The good news? It’s not as difficult as you might think.

As long as you have a valid visa and a stable income in the UK, most lenders will consider your mortgage application just like anyone else’s.

In this post, I’ll explain exactly what lenders look for, what documents you’ll need, and how to give yourself the best chance of approval.

What the BNO Visa Means for Mortgage Applications

The BNO visa allows eligible Hong Kong residents and their families to live, work, and study in the UK, with the opportunity to apply for permanent residency after five years.

From a mortgage lender’s point of view, this visa type is very positive — it gives you the legal right to live and work in the UK, which means most mainstream lenders are happy to lend to you.

However, because BNO applicants are often new to the UK, lenders will want to see a few key things to assess your application properly:

- That you’re living and working in the UK

- That you have a UK-based income

- And that you can provide the usual financial documentation, such as payslips and bank statements.

Having a Stable UK Income Is Key

When it comes to mortgage approvals, income is everything.

Lenders need to see that your income is stable and ongoing — whether you’re employed or self-employed.

If you’re employed in the UK, lenders will usually ask for:

- At least 3 months of payslips

- A P60 or employment contract

- Bank statements showing your salary paid into a UK account

If you’re self-employed, you’ll normally need at least one to two years of accounts or tax returns (SA302s or tax year overviews). Some specialist lenders are flexible if you’ve recently started your business and have a strong professional background.

Having your income clearly documented is often the most important part of getting a mortgage as a BNO visa holder.

How Much Deposit Do You Need?

In most cases, BNO visa holders need the same deposit as any other UK borrower.

Here’s a general guide:

- 5% deposit – minimum for some lenders (if you have a strong credit score and income)

- 10% deposit – most common for first-time buyers

- 15–25% deposit – may help you access lower rates or if your credit history in the UK is limited

If your funds are coming from Hong Kong, that’s fine — you’ll just need to provide evidence of where the money came from (such as a savings account or property sale). This is a standard anti–money laundering requirement and applies to all buyers, not just BNO visa holders.

Building a UK Credit History

One of the few hurdles new arrivals face is a lack of UK credit history.

Even if you’ve always been financially responsible in Hong Kong, UK lenders can’t see your overseas credit record — so you’ll need to start building one here.

You can quickly improve your UK credit profile by:

- Opening a UK bank account and using it regularly

- Applying for a credit card and paying it off in full each month

- Registering on the electoral roll (once eligible)

- Keeping all bills and rent payments up to date in your name

After just a few months, you’ll have a stronger credit footprint — which makes a big difference when applying for a mortgage.

Using Overseas Savings for Your Deposit

Many Hong Kong BNO visa holders use money from Hong Kong savings or property sales for their UK deposit.

That’s perfectly acceptable, but lenders need to see a clear trail of where the money came from and how it was transferred.

You’ll likely need:

- Bank statements showing the source of funds

- Transfer documentation from Hong Kong to the UK

- A short written explanation (if needed)

Having this documentation ready early helps avoid delays once you’ve found a property.

What Types of Mortgages Can BNO Visa Holders Apply For?

BNO visa holders can apply for the same types of mortgages as any other UK resident, including:

- First-time buyer mortgages

- Home mover mortgages

- Remortgages

- Buy-to-let mortgages

Not all lenders are familiar with the BNO visa yet, but many are — and more are adding it to their approved visa lists every year.

A good mortgage adviser can help match you with lenders who understand your situation and are more flexible with requirements.

What Documents Will You Need?

To apply for a mortgage, most lenders will ask for:

- Your passport and BNO visa

- Proof of UK address (such as a tenancy agreement or council tax bill)

- Payslips and bank statements (3–6 months)

- Evidence of your deposit and source of funds

- A UK credit report (if available)

Having these ready in advance helps speed up the process and makes your application look professional and organised.

Why Use a Mortgage Adviser Who Understands BNO Applications

While it’s not “difficult” to get a mortgage as a BNO visa holder, the process can be smoother with the help of an experienced mortgage adviser — especially one who understands both UK lending rules and the needs of clients moving from Hong Kong.

A good mortgage adviser can:

- Identify which lenders accept BNO visa holders

- Help prepare your documents correctly

- Find competitive rates suited to your circumstances

- Explain each step clearly, even if English isn’t your first language

At Chris Hazell Mortgages, we’ve helped many clients from Hong Kong buy homes in Leamington Spa, Stratford-upon-Avon, and across the UK. We also offer support for Cantonese-speaking clients, making the process simple and comfortable for everyone.

In Summary

So — is it difficult for Hong Kong BNO visa holders to get a mortgage in the UK?

Not really. If you have a valid visa, a steady UK income, and clear financial documents, there’s no reason you can’t access the same mortgage options as other UK residents.

With a little preparation and the right advice, owning a home in the UK can be a smooth, achievable goal for Hong Kong families and professionals starting their new chapter here.

If you’d like to explore your options or get a clear idea of how much you could borrow, feel free to get in touch, you can book a call here.

Important Information

- YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

- This blog is for general information purposes only and should not be considered personal financial advice.