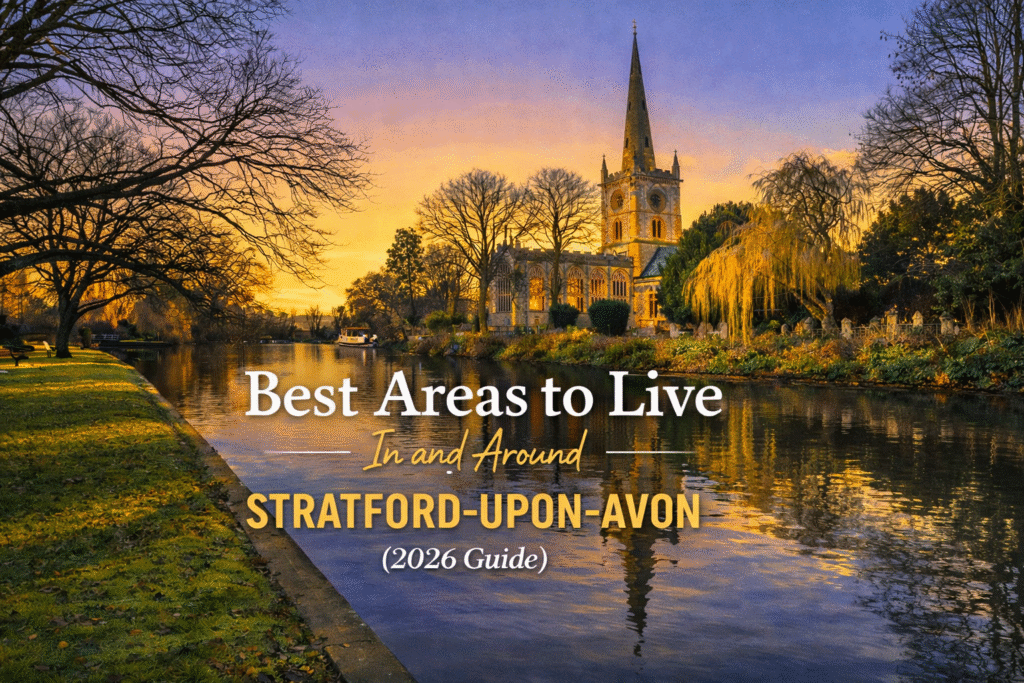

Best Areas to Live In and Around Stratford-upon-Avon (2026 Guide)

Stratford-upon-Avon is one of Warwickshire’s most desirable places to live — offering a unique mix of historic charm, great schools, a vibrant town centre, and beautiful countryside on the doorstep. Whether you’re a first-time buyer, a growing family, or looking for a quieter village lifestyle with easy access to the M40, Stratford has something for…

Best Areas to Live In and Around Stratford-upon-Avon (2026 Guide) Read More »